Research shows the best way to sell a product is to probe customers’ needs. But why wait until the product is developed? If you probe beforehand, you’ll create a better product and “pre-sell” your product. This isn’t practical for interviewing millions of B2C toothpaste buyers, but it is for concentrated B2B markets. B2B engagement skills aren’t difficult. Do you have them?

More in 2-minute video at 29. Engage your B2B customers

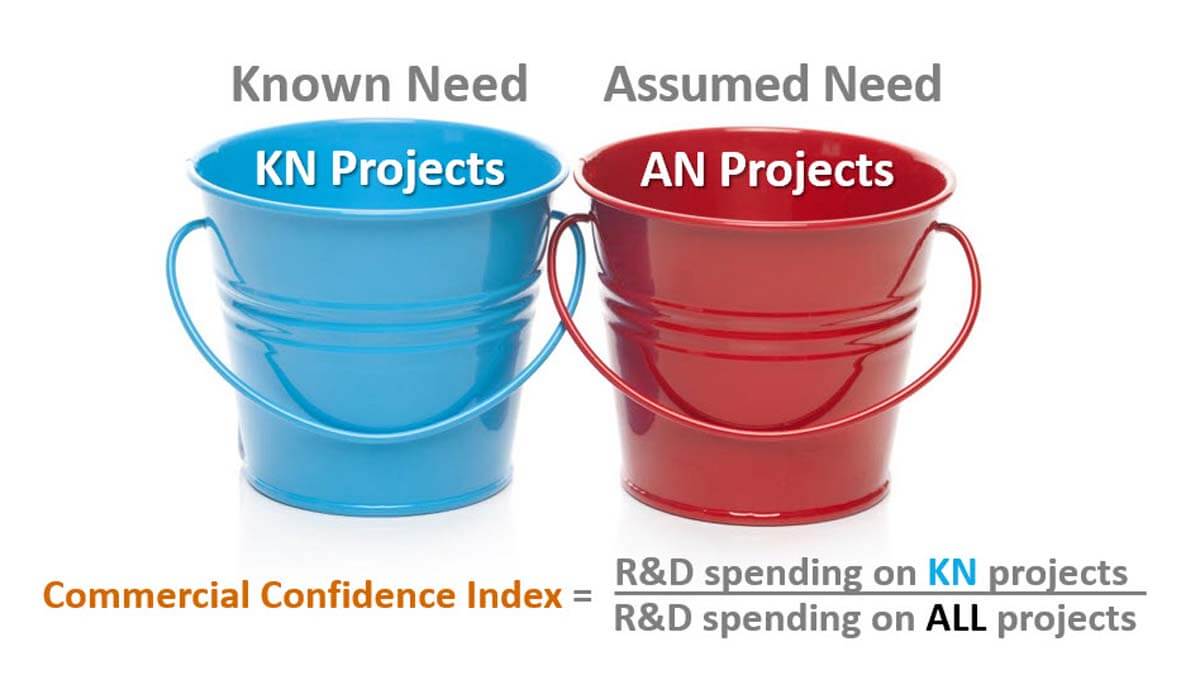

Yes, it’s called the Commercial Confidence Index (CCI), and it’s easy to calculate: Step 1: Record your annual R&D spending for each significant product development project. Step 2: For each project, ask if you have quantified evidence of customer needs, e.g. Market Satisfaction Gaps. If “yes,” the project goes in the “Known Need” bucket. All others go in the “Assumed Need” bucket. Step 3: The CCI is your annual R&D spending on Known-Need projects divided by annual spending on all product development projects.

More in 2-minute video, Employ new growth metrics

Extruder Die: This “output” represents your financial results. Fast-moving, high-quality output is like top-line growth and profitability. Feed Hopper: These are market-facing innovation projects supported by customer insight. Drive Screw: This is the work needed to transform the feed into high-value products, done by skilled, focused people.

The only way to get better extruder die output is to focus on the feed hopper input and drive screw horsepower. Watching the extruder die is just a spectator sport. Which is precisely what you’re engaged in during financial reviews. Wouldn’t you rather be in a participant sport? Then go to your feed hopper, and work on new products customers will love. See 2-minute video, Extend your time horizon.

More in article, B2B Organic Growth: 8 top lessons for leaders.

It’s pretty obvious that one objective is customer insight—understanding customer needs so you can develop the right product. The oft-overlooked objective is customer engagement. This is conducting your voice of customer interviews in a manner that “primes” customers to buy your product when you’re done developing it. Do this well and you sell your product before it even exists. Learn more about customer engagement in the 2-minute video, Engage your B2B customers.

More in article, The Missing Objective in Voice of Customer Interviews

Move your organization up through these levels: 1) Conference-roomers: We meet with ourselves to decide what customers want. 2) Expert-askers: We poll our own sales and tech support personnel. 3) Customer-surveyors: We get customer answers… but only to our questions. 4) Qualitative VOC-ers: Our interviews move us from voice-of-ourselves to voice-of-customer. 5) Quantitative VOC-ers: We get unbiased, unfiltered insights. 6) B2B VOC-ers: Our probing takes advantage of powerful B2B advantages.

More in article, The six levels of B2B customer engagement

I’m still looking for the business that failed—or even suffered—from understanding customers too well. Maybe I should stop looking for this rare “black swan” event? It’s certainly no challenge finding companies that don’t understand customer needs well. Sadly, many also don’t understand how badly their lack of customer insight is stunting their growth. Get this right and you may not be a black swan… but you’ll certainly stand out from the rest of the flock.

See video on B2B voice-of-customer at www.vocforb2b.com.

Did you buy home-owner insurance… even though it’s unlikely your house will burn down this year? How confident are you that you truly understand customer needs when you develop new products? Our research shows most companies do not. So why not have your teams trained in the latest B2B voice-of-customer insight methods? Think of it as insurance. Or better yet… as a strong preventative, like fire-proofing your house.

See video on B2B voice-of-customer at www.vocforb2b.com.

Do you want to think only about your next move, or think five moves ahead? Here’s a 5th order plan to maximize shareholder wealth: 1st Order: Develop superior customer insight capabilities. 2nd Order: Understand market needs better than competitors. 3rd Order: Develop high-value products focused only on these needs. 4th Order: Sustain superior growth from these products. 5th Order: Impress shareholders with your proven growth track.

More in article, Stop Stifling B2B Organic Growth with 2nd Order Effects

Over the years, we’ve seen business leaders question the employee time and airfare bills needed to interview customers in the front-end of innovation. But how much R&D and marketing was squandered developing a product that made customers yawn? That’s a question that should probably be asked more often.

More in white paper, Guessing at Customer Needs

Most sales professionals are rewarded for one thing. Selling. This year. But if you want to sell a lot more in 2-3 years, better learn today what customers really want. Who better to do this than the people you’re paying to meet with customers daily? Perhaps future companies will unleash sales-and-learning pros… not just sales pros.

Learn more about B2B innovation at theaiminstitute.com

In either case you should ask, “What was I thinking of when I started this?” Especially if you are a B2B supplier with knowledgeable, interested, rational customers, who want you to know their needs. And a science already exists for completely understanding these needs. Maybe it’s time to stop throwing salt and begin learning a better approach?

Learn more in our e-book, Reinventing VOC for B2B

Research shows the best way to sell a product is to probe customers’ needs. But why wait until the product is developed? If you probe beforehand, you’ll create a better product and “pre-sell” your product. This isn’t practical for interviewing millions of B2C toothpaste buyers, but it is for concentrated B2B markets. B2B engagement skills aren’t difficult. Do you have them?

More in newsletter, How to Grow in a Stagnant Economy (Nov-Dec, 2008)