In either case you should ask, “What was I thinking of when I started this?” Especially if you are a B2B supplier with knowledgeable, interested, rational customers, who want you to know their needs. And a science already exists for completely understanding these needs. Maybe it’s time to stop throwing salt and begin learning a better approach?

Learn more in our e-book, Reinventing VOC for B2B

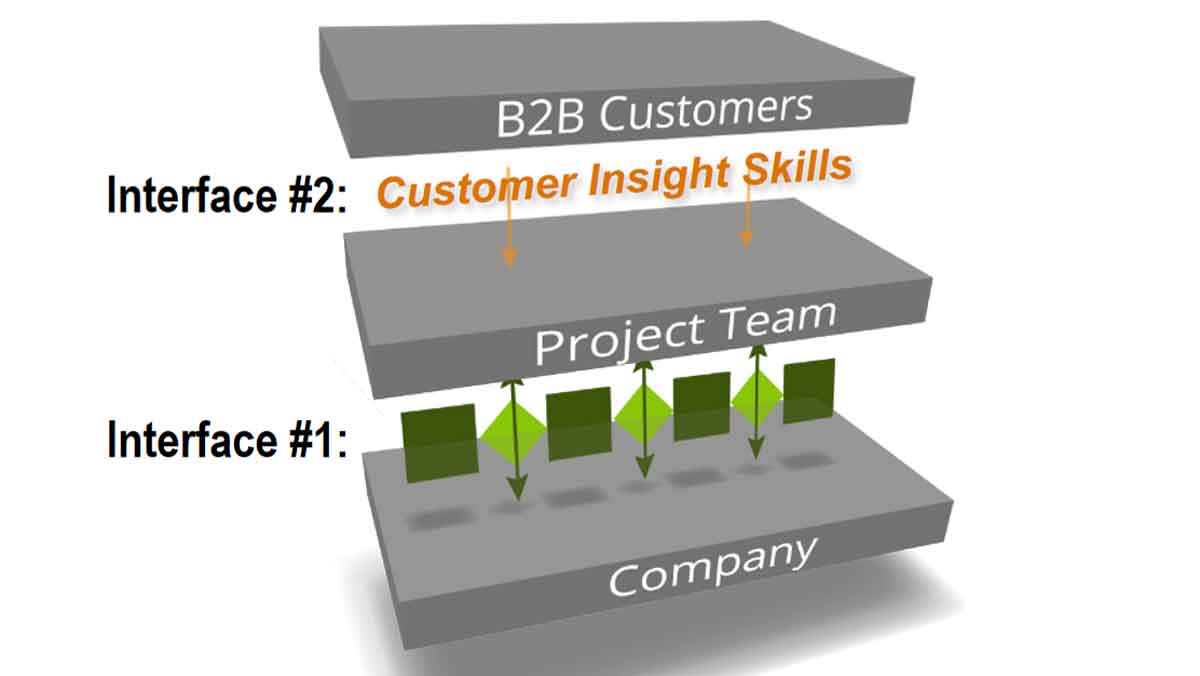

Your stage-and-gate process is the interface between your company and project teams… doing vital work like preventing mistakes, planning resources, and creating portfolio views. Keep it, but add another interface on top… between the teams and customers. This interface is “customer insights skills.” Together they’re a dynamic duo.

More in white paper, Guessing at Customer Needs (page 9).

Some voice-of-customer experts recommend you exclude your salesforce from interviews because “they can sell but not listen.” True sales professionals are actually great listeners: You just need to reward them for listening. Strengthen listening and learning by your entire team, and you’ll out-perform competitors who side-line their sales pros when gathering market insights.

More in e-book, Reinventing VOC for B2B (page 24).

It’s usually a sign the new-product team has a supplier-centric mindset, not a customer-centric one. Validating hypotheses is converging around a supplier solution… which should occur after diverging around customer needs. It’s important to get the sequence right. Look around and study Problem Solving 101: Divergent thinking nearly always precedes convergent thinking.

More in article, Reduce Bias in Voice of the Customer

I worked in manufacturing in the 1970s, when it seemed like “overkill” to train operators in statistics for quality control. But this is expected today. I met Dr. Deming in the 1980’s and heard him say, “It is not necessary to change. Survival is optional.” Compared to statistics, the science of B2B customer insight is quite simple. Will you be GM or Toyota in the innovation wave?

More in white paper, Catch the Innovation Wave (page 12).

I call this the golden rule of investment. In the case of innovation, it explains why the front-end-of-innovation is the critical battleground. The winning company is the one that most efficiently learns whatever intelligence is needed to drive this important decision: “Should we advance this project into the costly development stage?”

More in article, Should Your Stage-Gate® Get a No-Go?

Many think new product pricing is determined by how much value a supplier delivers to customers… but that’s not strictly true. Pricing is driven by customers’ perception of value delivered. Therefore, you need to give prospective buyers a value calculator or similar tool, so they can see how much money they’ll make or save.

More in white paper, Catch the Innovation Wave (page 12).

B2B producers often take a DIY approach, while B2C marketers hire research firms. Why? For one thing, consumer products often have bigger annual revenues: Think of all the small B2B parts in a big-ticket item like a smart phone. For B2C it’s all about that launch. But B2B companies often “turn the crank” on many smaller new products… so its economical to develop in-house expertise.

More in article, You Already Answered 4 Questions, but… Correctly?

It would seem obvious that new product development should be focused on those who will pay for these products: customers. It would seem. Yet B2B suppliers routinely pursue their own ideas, concepts and hypotheses, paying too little attention too late to market needs. True customer-centric innovation is a completely different mindset.

More in article, Is Your Innovation Supplier-Centric… or Customer-Centric?

Professional interviewers can be helpful at times… but ultimately, customer insight skills are a competitive edge your company should own. Your B2B customers want to talk to the people who will innovate on their behalf… not some note-taking middle-men. And there’s nothing quite like hearing new customer insights first-hand, is there?

More in e-book, Reinventing VOC for B2B (page 23).

Many ventures try to create new products or services under conditions of market uncertainty. This is a huge challenge for B2C. But uncertainty does not exist in the minds of most B2B customers… who have great knowledge, interest, objectivity and foresight. If you know how to access this, your supplier uncertainty will plummet.

More in white paper, Lean Startup for B2B (page 12).

Understand customer outcomes thoroughly before entering solution space. The drill bit is the supplier solution; the hole is the customer outcome. For every job, there are scores of outcomes your product could deliver… how fast the hole is drilled, how accurately, how easily centered, how much mess is created, etc. Outcome insight leads to solution brilliance.

More in article, The Inputs to Innovation for B2B

We asked how much B2B-optimized interviews impacted teams’ designs for the products they were developing. Five out of six teams said the impact was “great” or “significant.” Hmmm… makes you wonder what those products would have looked like without these interviews. Do you think your new products could be improved this way?

More in white paper, Guessing at Customer Needs (page 2).

Many companies develop and lob new products at their B2B customers without first exploring their needs. There may be less efficient ways to understand customer needs than waiting to see if they buy your product… but I truly don’t know what they would be. Years from now, companies will be amazed that our innovation methods were so supplier-centric and inefficient.

More in white paper, Timing is Everything (page 5).