These may be the same… or not. If you make welding machines, your customers’ alternatives may be mechanical fasteners or epoxy adhesive. When you have a choice between supplier-centric or customer-centric thinking, always choose the latter. Exploring customers’ alternatives passes this customer-centricity test.

More in article, Benchmarking for B2B Product Innovation

We asked this question of new-product teams that had conducted a total of 875 B2B-optimized customer interviews. 96% said these interviews would have a moderate, significant or great impact on their company’s organic growth rate. Only 4% said the impact would be “slight.” About the same amount also felt such interviews would positively impact their company’s culture.

More in white paper, Guessing at Customer Needs (page 10).

Many B2B suppliers consider competitive pricing as they plan new-product pricing. Or worse, cost-plus pricing. Both are irrelevant if you deliver real value to customers… not a “me-too” product. Competitive pricing just helps you judge initial customer reaction, and cost-plus just sets the pricing floor. Neither tells you what customers will pay. For that, you need customer-value pricing.

More in article, New Product Pricing: Capturing Freshly Created Customer Value

Most sales professionals are rewarded for one thing. Selling. This year. But if you want to sell a lot more in 2-3 years, better learn today what customers really want. Who better to do this than the people you’re paying to meet with customers daily? Perhaps future companies will unleash sales-and-learning pros… not just sales pros.

Learn more about B2B innovation at theaiminstitute.com

It may be that your customers’ customers opinions matter more. Somewhere in your downstream value chain, there’s a “drive sprocket” that’s moving the rest of the value chain. Find it, uncover all their needs, quantitatively isolate the critical ones, and pursue these like there’s no tomorrow.

More in e-book, Reinventing VOC for B2B (page 26).

You’re developing your customer’s new product. It’s like this: “Mr. Customer, we’ve assembled a team aimed at developing something you’ll love. As you can see, we even brought a lead R&D person with us to listen to you. So can you tell us everything you think we should know before we going into our labs? We want to get this right so the innovation makes you a hero at work.”

More in article, Reduce Bias in Voice of the Customer

What else is there besides hearing customers’ needs? Impress them so they’ll want to do business with you. Incorporate your insights into a value calculator to optimize pricing. Use their precise interview language on your website to improve SEO. Uncover unspoken needs in a post-interview customer tour. Understand their next best alternative. Never stop learning.

More in article, You Already Answered 4 Questions, but… Correctly?

When you say you want to pursue a “new market,” do you mean the market is truly embryonic? Or is this just a new market for you? If so, it’s better to call the latter an “unfamiliar market.” The customers were already there. It’s you—not the market—that’s new. This is just one example of supplier-centric thinking that permeates B2B innovation. Customer-centric thinking will take you much further.

More in white paper, Innovating in Unfamiliar Markets (page 2).

In either case you should ask, “What was I thinking of when I started this?” Especially if you are a B2B supplier with knowledgeable, interested, rational customers, who want you to know their needs. And a science already exists for completely understanding these needs. Maybe it’s time to stop throwing salt and begin learning a better approach?

Learn more in our e-book, Reinventing VOC for B2B

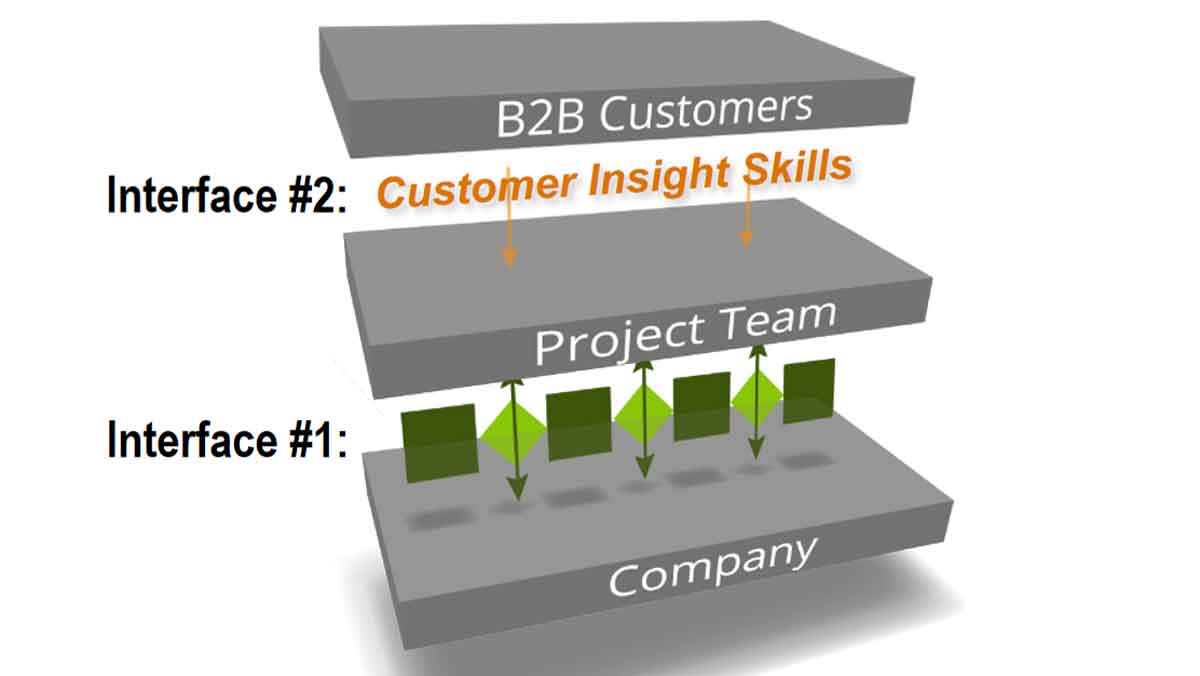

Your stage-and-gate process is the interface between your company and project teams… doing vital work like preventing mistakes, planning resources, and creating portfolio views. Keep it, but add another interface on top… between the teams and customers. This interface is “customer insights skills.” Together they’re a dynamic duo.

More in white paper, Guessing at Customer Needs (page 9).

Some voice-of-customer experts recommend you exclude your salesforce from interviews because “they can sell but not listen.” True sales professionals are actually great listeners: You just need to reward them for listening. Strengthen listening and learning by your entire team, and you’ll out-perform competitors who side-line their sales pros when gathering market insights.

More in e-book, Reinventing VOC for B2B (page 24).

It’s usually a sign the new-product team has a supplier-centric mindset, not a customer-centric one. Validating hypotheses is converging around a supplier solution… which should occur after diverging around customer needs. It’s important to get the sequence right. Look around and study Problem Solving 101: Divergent thinking nearly always precedes convergent thinking.

More in article, Reduce Bias in Voice of the Customer

I worked in manufacturing in the 1970s, when it seemed like “overkill” to train operators in statistics for quality control. But this is expected today. I met Dr. Deming in the 1980’s and heard him say, “It is not necessary to change. Survival is optional.” Compared to statistics, the science of B2B customer insight is quite simple. Will you be GM or Toyota in the innovation wave?

More in white paper, Catch the Innovation Wave (page 12).

I call this the golden rule of investment. In the case of innovation, it explains why the front-end-of-innovation is the critical battleground. The winning company is the one that most efficiently learns whatever intelligence is needed to drive this important decision: “Should we advance this project into the costly development stage?”

More in article, Should Your Stage-Gate® Get a No-Go?